irs tax levy form

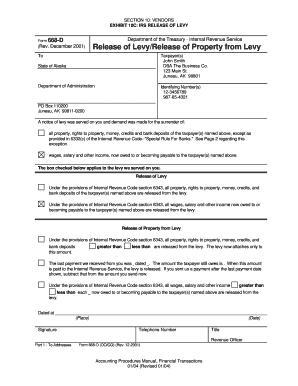

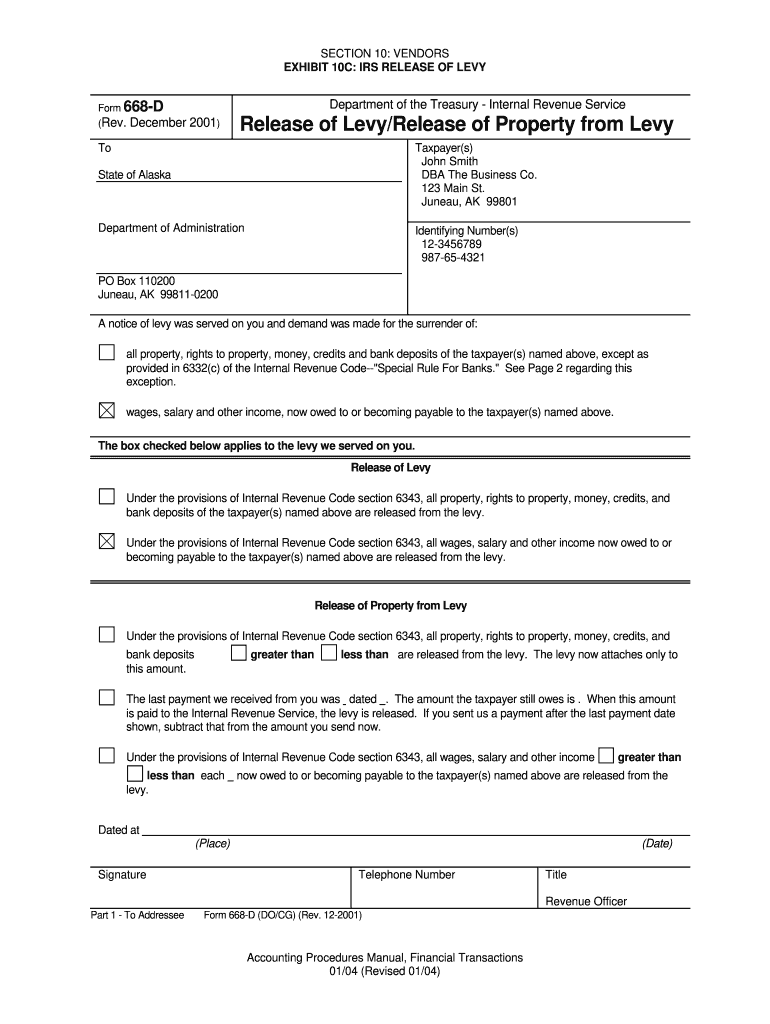

A tax levy allows the IRS or state government to physically seize your property to satisfy that liability. The IRS releases a levy on third parties by issuing form 668-D.

Avoiding Federal Tax Levy What Is A Levy Ohio Tax Lawyer

If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD.

. The party receiving this levy is obligated to take money owed to you and pay the money to the IRS until your back taxes are fully paid. To ensure the correct exemption amount is excluded from levy your employer will ask you to complete a Statement of Exemptions and Filing status Form 668-W Part 3. A levy is a legal seizure of your property to satisfy a tax debt.

Form 668-E Release of Levy. Department of the Treasury Internal Revenue Service Notice of Levy on Wages Salary and Other Income Form 668-WcDO Rev. The IRS also uses this form to create levies on pension and retirement funds.

Form 668-W is the form the IRS sends to employers when it wants to levy a taxpayers wages. That is not all The IRS can seek to foreclose on your home and. Commonly a tax levy takes the form of wage garnishments bank levies and seizure of state tax refunds.

That is not all The IRS can seek to foreclose on your home and. Form 668-A Notice of Levy. One way to think about an IRS levy is that it is an opportunity for the IRS to satisfy any tax debt or other penalties you may owe to them by directly inserting themselves into some form of.

Form 668-W Notice of Levy on. Collection Appeal Request February 2020 Department of the Treasury - Internal Revenue Service Instructions are on the reverse side of. A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from levy.

Read the Form carefully. A paper levy is a levy generated on a Form 668-A or Form 668-W Notice of Levy on Wages Salary and Other Income and issued through the ACS either systemically or by an employee. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes.

Levies are different from liens. Form 668-A Notice of Levy. July 2002 THIS ISNT A BILL FOR TAXES YOU OWE.

The release of levy on property seized from the taxpayer is form 668-E Form 668-D has provisions for a partial release of levy. Form 668-E Release of Levy. Before the IRS files a lien you will receive a tax notice or bill.

Commonly a tax levy takes the form of wage garnishments bank levies and seizure of state tax refunds. Form 668-B Levy seize a taxpayers property Form 668-D Release of Levy Release of Property from Levy third party holders of taxpayers wages or properties Form 668. Form 668-W Notice of Levy on.

The Form tells who the levy was. Form 668-D Release of Levy Release of Property from Levy. Form 668-D Release of Levy Release of Property from Levy.

Intent To Levy Notice Colonial Tax Consultants

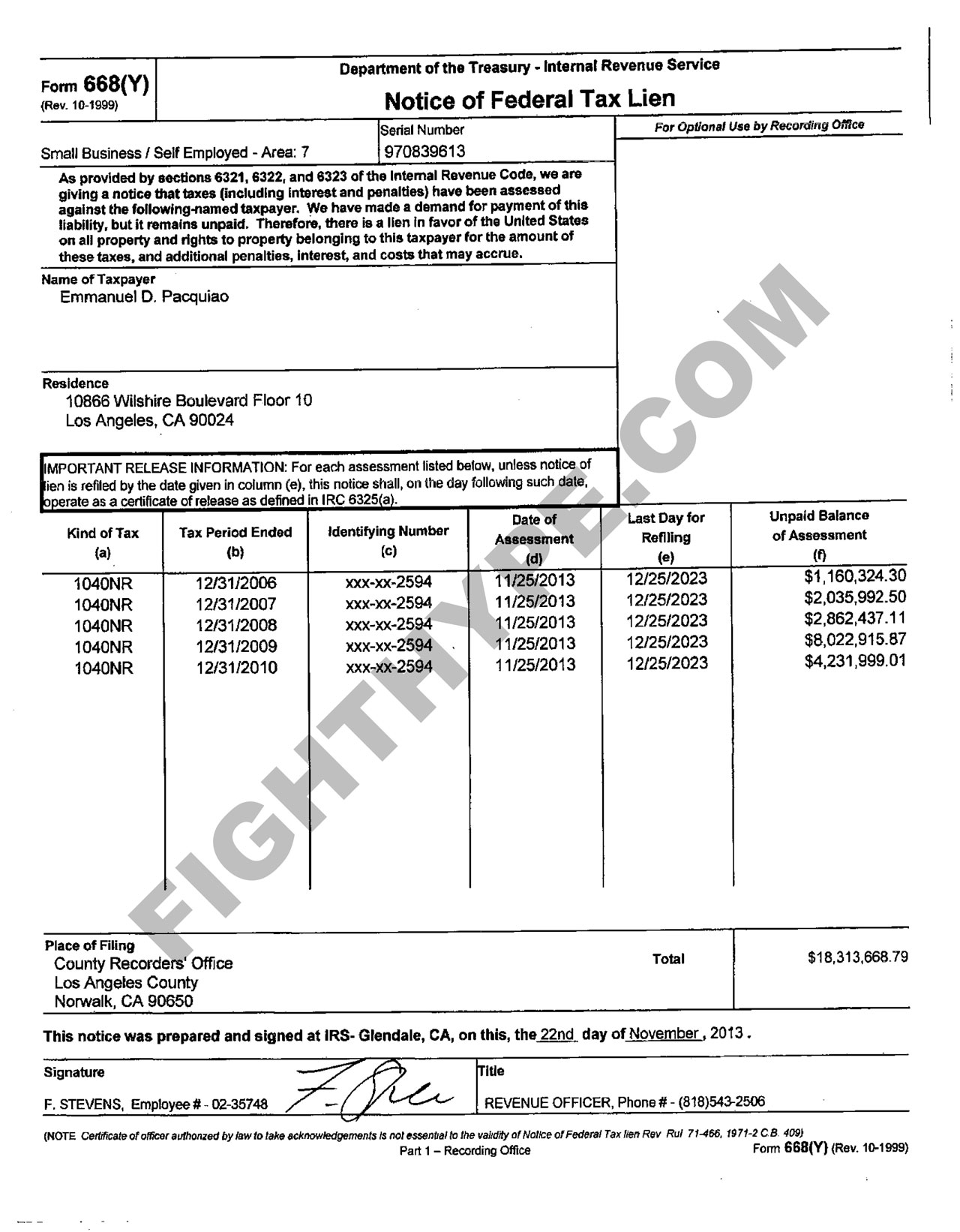

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

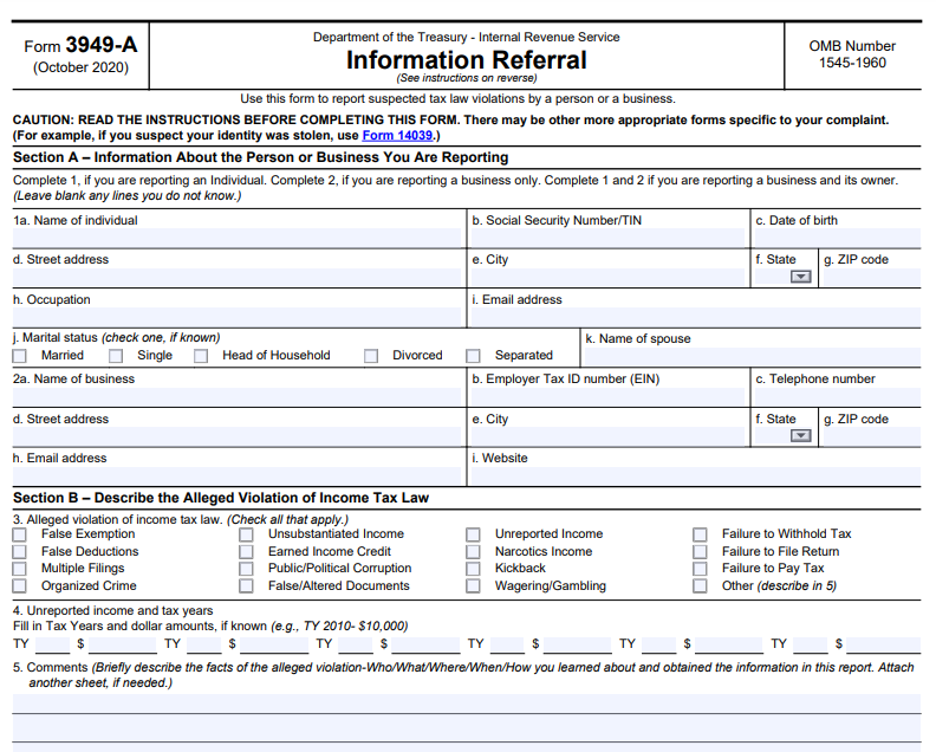

Can Someone Turn Me In To The Irs Jackson Hewitt

Irs Notices Form 668 A C Understanding Of Irs Form 668 A Non Continuous Levy Immediate Action Required

Understanding Your Irs Form W 2

Release Of Irs Tax Liens Hutto Associates

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Form 668 D Pdf Fill Out And Sign Printable Pdf Template Signnow

Notice Of Deficiency From The Irs Don T Panic Here S What You Can Do

Irs Tax Lien Versus Irs Tax Levy

Turning In U S Tax Cheats And Getting Paid For It Don T Mess With Taxes

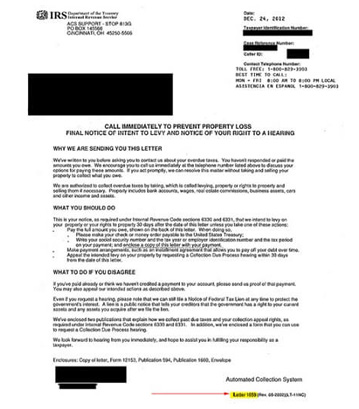

Irs Form 1058 Notice Of Intent To Levy

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Form 12153 Request For A Collection Due Process Or Equivalent Hearing

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

No Download Needed Irs Form 668y Pdf Fill Out Sign Online Dochub

Irs Form 12277 Application To Withdraw Federal Tax Lien From Credit Report